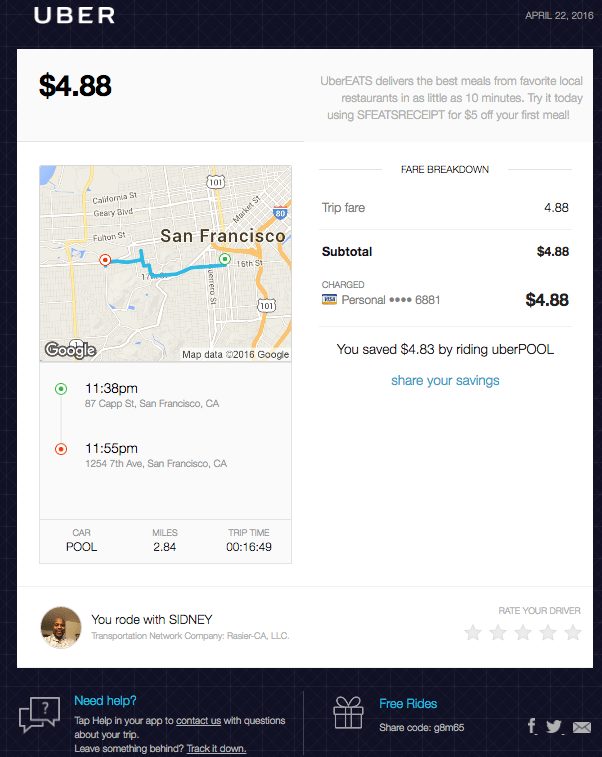

You can deduct some Uber rides as deductibles on the next tax return you send over to the IRS. If you’re claiming Uber rides as an expense on your taxes, you need to keep detailed records of those rides for at least three years.Ĭan You Deduct Uber Rides on Your Tax Return? You’re not allowed to deduct Uber rides from your tax return if they’re part of your commute or for personal reasons. Uber fares qualify as tax deductible if the costs are associated with ordinary or necessary business travel.

#Uber receipts for business how to#

That’s why we’ve created this quick guide to walk you through the rules on travel-related expenses, how to deduct business miles and Uber rides, and what records you need to keep for your tax returns. Unfortunately, the answer is a little bit complicated. But with the advent of popular ride-sharing services like Uber and Lyft, you might be wondering: can you deduct Uber expenses on your tax return? The IRS has all sorts of long-standing rules in place for old-school modes of travel. That’s why the tax body allows you to claim back certain travel expenses as tax deductibles. Fortunately, the IRS recognizes these creeping costs have a major impact on your bottom line. According to researchers at Statista, the average business trip costs over $309 per day in expenses.

0 kommentar(er)

0 kommentar(er)